Storage business seen from map data

Mr. Akira Sugawara

Yano Research Institute Ltd.

This is an English translation of the original Japanese article.

Areas with high concentrations of storage service business units (rental storage, container storage, trunk-room)

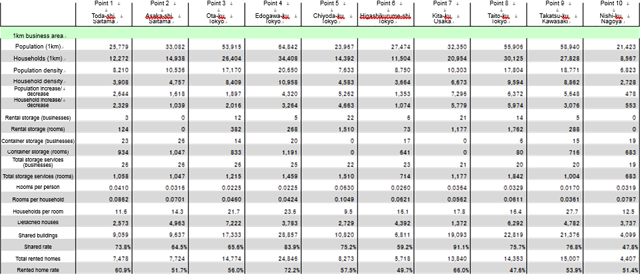

Of the 7,000 or so areas with storage services nationwide, the top ten are shown in figure 1. Three areas have 26 storage service business units within a one-kilometer radius. Nine of the 7,000 areas (0.1%) have 20 or more business units.

Among the top ten, five are in Tokyo, two in Saitama Prefecture, and one each in Kanagawa, Osaka and Aichi Prefectures, indicating that there are more storage services in areas of high population density (and especially relatively residential areas.)

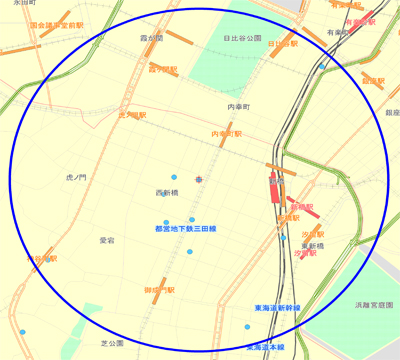

One peculiarity is the high concentration of storage service business units around the point in Chiyoda-ku, Tokyo in spite of it being a business center. The area has a large daytime population but not many residents. In many cases, empty floor space in multi-tenant buildings and aging buildings has been converted to provide rental storage. That is why there are zero container storage business units. In the same way, the point in Kita-ku, Osaka is dense in storage service business units but has zero container storage business units. Conversely, Asaka-shi, Saitama and Nishi-ku, Nagoya, also dense in storage service business units, have zero rental storage business units.

I would like to bring your attention to the “Rooms per household”. A figure of 0.1 means there is a storage space for one out of every ten households. It is also surprising that there are so many households around point 5 in Chiyoda-ku, Tokyo, but the total number of storage spaces is on a par with the self-storage market in the US. Presumably, however, many users in that area are corporations or commuters rather than residents.

Storage services are still a growing market and so, while it is also important to look for areas with no storage services at all, an operator with a dominant concentration may still be able to acquire users even with other companies’ services in the area. Also, since rental storage and container storage meet different user needs, there is excellent potential for rental storage to coexist in an area with a lot of containers.

[Figure 1 Areas with high concentrations of storage service business units]

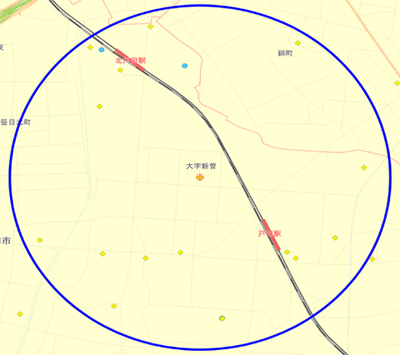

[Figure 2 Point 1: Toda-shi, Saitama]

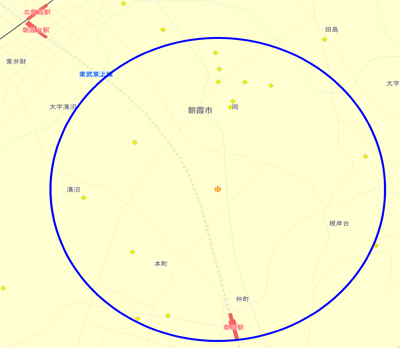

[Figure 3 Point 2: Asaka-shi, Saitama]

[Figure 4 Point 5: Chiyoda-ku, Tokyo]

Areas with many rental storage rooms per household

Next, let’s look at areas that have many rental storage rooms rather than business units.

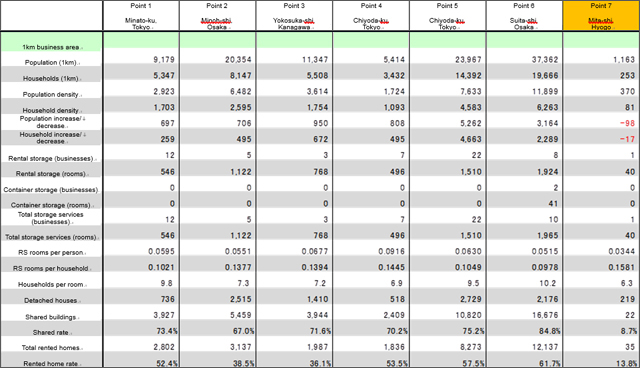

I have picked out the areas where there are a lot of rental storage rooms per household (around 0.1 RS rooms per household.) I selected this level of 0.1 because it is almost the same as that of self-storage rooms per household in the US. Business area size actually differs depending on the scale of business units (the total number of rooms per business unit), but because there were relatively many urban area business units this time, I have only considered the data within business areas of one kilometer in radius. I will therefore introduce areas with full data.

A further examination of only data revealed levels above 1.0 in cases where warehouses are being leased out as rental storage in places with small populations such as Sapporo in Hokkaido or Tateyama in Chiba. I treated this as anomalistic data, because although the business areas in large cities are one kilometer in radius, in regional cities where the means of transportation is by car they are often up to five kilometers in radius, and I selected relevant places from those with a business area population of around 10,000.

*Reference case: Figure 5 Point 7 Mita-shi, Hyogo (shaded column)

Spreading rental storage within a low-population business area leads to an increase in the number of rooms per household within a one-kilometer radius business area.

Point 1 in Minato-ku, Tokyo is in an area dense with business and commercial facilities so although it is urban it has a low population within its business area. Twelve rental storage business units have been developed there. The number of RS (rental storage) rooms per household is therefore in excess of 0.1. Other points (Points 4 and 5) in Chiyoda-ku, Tokyo, which has many business units, are also in areas with a lot of rental storage.

[Figure 5 Areas with a lot of rental storage per household]

[Figure 6 Point 1: Minato-ku, Tokyo]

[Figure 7 Point 5: Chiyoda-ku, Tokyo]

[Figure 8 Point 6: Suita-shi, Osaka]

Analyzing GIS data in this way lets you see storage business in a different light. Next time you find a vacant lot nearby, or a building with a vacant tenancy, rather than renting it as a storage business, why not consider factors such as local competition and population and try to enter the market as a player (service provider) instead?

About the Yano Research Institute

The Institute conducts comprehensive research and analysis on appropriate themes from a micro and macro perspective to determine trends in market size, business share, future prospects, trends among major players, and the like in a broad range of business fields.

We focused early on the storage business field, which continues to grow, and we have provided detailed investigative reports based on thorough reporting since 2010.

We are making a significant contribution to improving transparency in the storage business industry, by analyzing the future prospects, potential, and issues in a market that had scarce information.